Acorns Early: Set up an investment account (UTMA/UGMA) under your child's name.You must link the credit or debit card to your Acorns account. Acorns Earn (Found Money): Shop with one of Acorns' 15,000+ retailer partners and a percentage of your purchase will be added to your Acorns Invest account.Members get access to 55,000+ fee-free ATMs and there are no overdraft fees. Acorns Checking: Checking account that includes direct deposit, mobile check deposits, online bill pay, and a metal debit card.The app automatically adjusts your investment portfolio to be more conservative as you get closer to retirement age. Acorns Later: Plan for retirement with a Traditional IRA, Roth IRA, and SEP IRA.The app will automatically rebalance your portfolio and reinvest dividends on your behalf. Just like with other online brokers, this is a taxable account, and your funds are subject to market losses. Acorns Invest: Invest your spare change.There are five main ways to grow your money: M1 Finance, for instance, offers automated investments with no monthly fee or advisory fees.

#Acorn investment app australia review free

It can be hard to justify $36 to $108 in fees each year when there are free alternatives available. Check the rest of their services below.Īcorns charges users $3 to $9 per month. The Acorns app lets you do a lot more than just invest spare change.

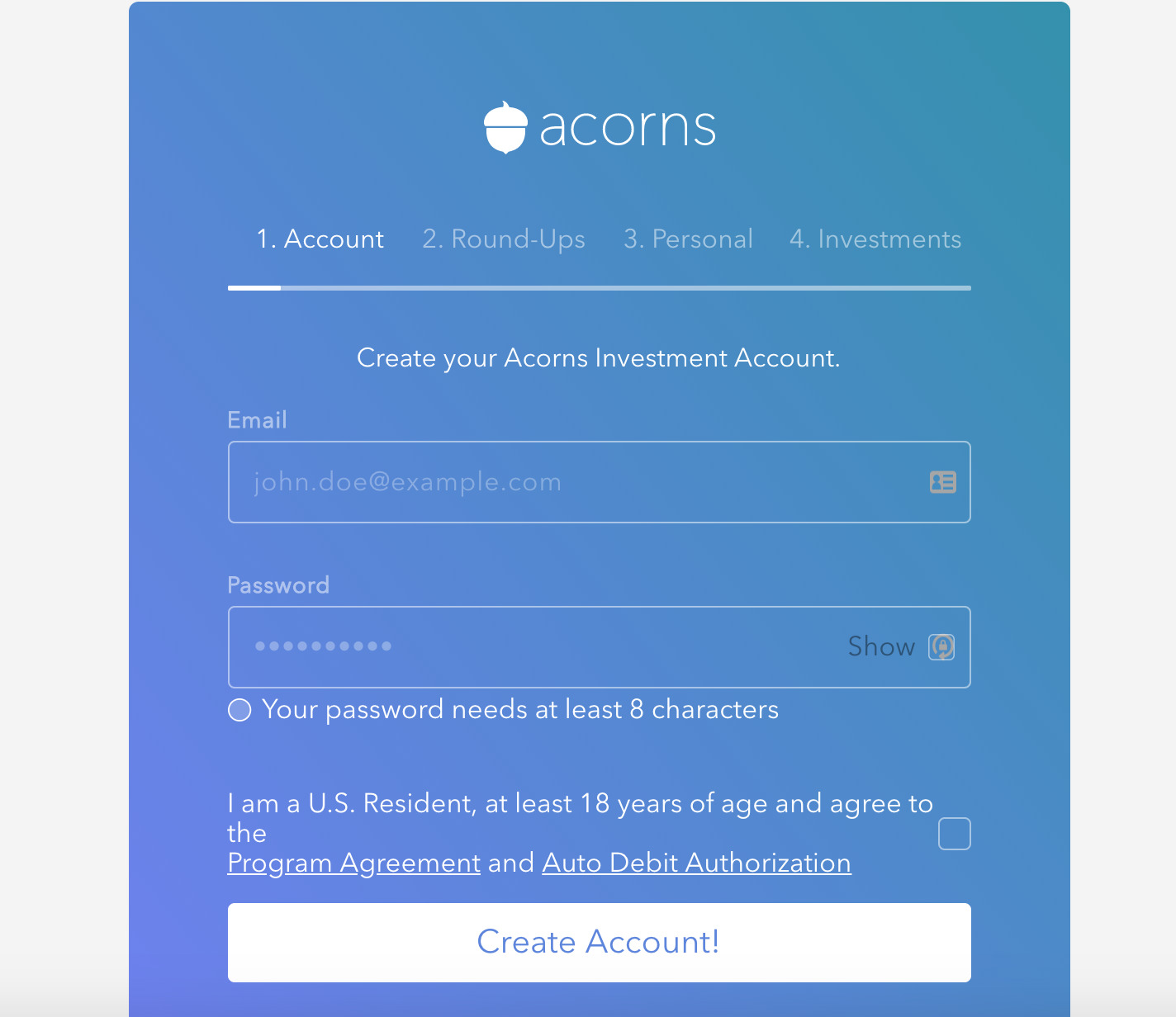

You can choose from four different account types when you sign up.

Rest assured, Acorns delivers secure data transmission (e.g., entering bank account information, passwords, etc.) and data storage (where your information is kept and protected).

#Acorn investment app australia review verification

Account security: Automatic logouts and ID verification to prevent unauthorized access.Bank-level security: Multiple layers of secure servers to safeguard financial information.Account alerts: Acorns will notify users if they detect unusual account activity as protection against fraud.Your personal and financial information can only be accessed by you and Acorns. SSL encryption: Both the website and app are secured with 256-bit encryption.FDIC-insured Spend accounts: Deposits in Acorns Checking account are insured up to at least $250,000 through partner banks.SIPC-protected investment accounts: Securities in Acorns Invest and Later accounts are protected up to $500,000.Here's a detailed overview on how they protect users' accounts and information: Acorns uses security measures that comply with federal law (including digital safeguards, secure servers, and bank-level physical security).

0 kommentar(er)

0 kommentar(er)