Medicaid-eligible member moves in or out of your home, or you are no longer responsible for their Medicaid case. The policyholder is not living with the Medicaid-eligible members. The health insurance ends, or the insurance carrier, premium or deductible, or coverage changes.  Mailing address changes (state checks do not get forwarded). Here are examples of some changes that need to be reported: You are required to report all changes that occur in your employment or health insurance, in your family and household. Call the number on the front of a HIPP notice. The quickest way to report changes is to: Changes may impact the benefit amount and who is considered HIPP eligible. You are required to report all changes to the Department within 10 days of the change. The health plan pays secondary to another plan. Someone who is covered under the insurance plan and is not Medicaid-eligible on the date the decision regarding eligibility for the HIPP program is made. The insurance plan is a subsidized insurance plan purchased through a government-run health insurance exchange. The insurance plan is a high deductible health plan, pursuant to the guidelines of the Internal Revenue Service (IRS). Anyone covered under Medicaid Kids with Special Needs (MKSN), Family Planning Program (FPP), or Health Insurance Plan Iowa (HIPIOWA). An insurance premium that is used to reduce the Medically Needy spend down amount for Medicaid or used as a deduction in computing the client participation.

Mailing address changes (state checks do not get forwarded). Here are examples of some changes that need to be reported: You are required to report all changes that occur in your employment or health insurance, in your family and household. Call the number on the front of a HIPP notice. The quickest way to report changes is to: Changes may impact the benefit amount and who is considered HIPP eligible. You are required to report all changes to the Department within 10 days of the change. The health plan pays secondary to another plan. Someone who is covered under the insurance plan and is not Medicaid-eligible on the date the decision regarding eligibility for the HIPP program is made. The insurance plan is a subsidized insurance plan purchased through a government-run health insurance exchange. The insurance plan is a high deductible health plan, pursuant to the guidelines of the Internal Revenue Service (IRS). Anyone covered under Medicaid Kids with Special Needs (MKSN), Family Planning Program (FPP), or Health Insurance Plan Iowa (HIPIOWA). An insurance premium that is used to reduce the Medically Needy spend down amount for Medicaid or used as a deduction in computing the client participation.  Plans that have an absent parent as the policyholder, or when the policyholder is not part of your Medicaid household. Plans that are limited to a temporary period of time. An insurance plan that pays income to the policyholder or pays only limited amounts for services. School plans based on enrollment or attendance as a student. Insurance for someone who does not live in your home. What the HIPP program does not provide premium assistance for: Medicaid is typically the only payer for wrap around benefits. For example, supported community living (SCL) services, case management, adult diapers, transportation, or school based services. "Wrap around benefits" or "wrap" are services not covered by a commercial health insurance plan. "Cost sharing" is the out-of-pocket cost that is not paid by the health insurance plan, but is the responsibility of Medicaid.

Plans that have an absent parent as the policyholder, or when the policyholder is not part of your Medicaid household. Plans that are limited to a temporary period of time. An insurance plan that pays income to the policyholder or pays only limited amounts for services. School plans based on enrollment or attendance as a student. Insurance for someone who does not live in your home. What the HIPP program does not provide premium assistance for: Medicaid is typically the only payer for wrap around benefits. For example, supported community living (SCL) services, case management, adult diapers, transportation, or school based services. "Wrap around benefits" or "wrap" are services not covered by a commercial health insurance plan. "Cost sharing" is the out-of-pocket cost that is not paid by the health insurance plan, but is the responsibility of Medicaid. #Deductible vs premium vs copay plus

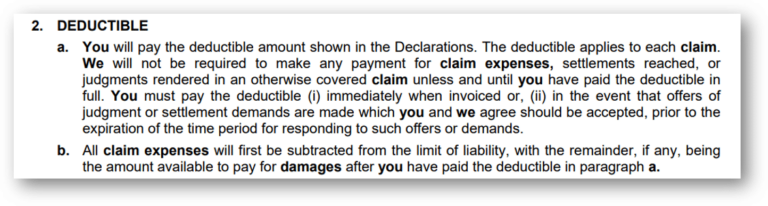

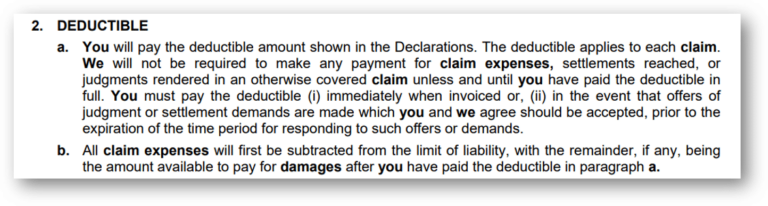

To determine cost-effectiveness, the HIPP program totals together the member's health insurance premium cost to cover the Medicaid eligible members, plus the deductibles, out-of-pocket cost, and administrative cost and compares all of this to what the Department would pay to a managed care organization (MCO) (based on age, sex, aid type). "Cost-effective" means a determination has been made that a savings will accrue to the Department by paying the insurance premium, cost sharing, wrap benefits, and administrative cost instead of paying for the same care through Medicaid managed care. What is cost-effective and how is it determined? The health plan must be cost-effective.You must have medical insurance or be able to get it through your employer.

You or someone in your home has to have Medicaid.

The HIPP program is a way for the State of Iowa to save money. The Health Insurance Premium Payment (HIPP) program is one of the services available to people who get Medicaid (Title 19). Report changes or ask a question about the HIPP program via email at What is the HIPP program?

0 kommentar(er)

0 kommentar(er)